Go dutch on a property

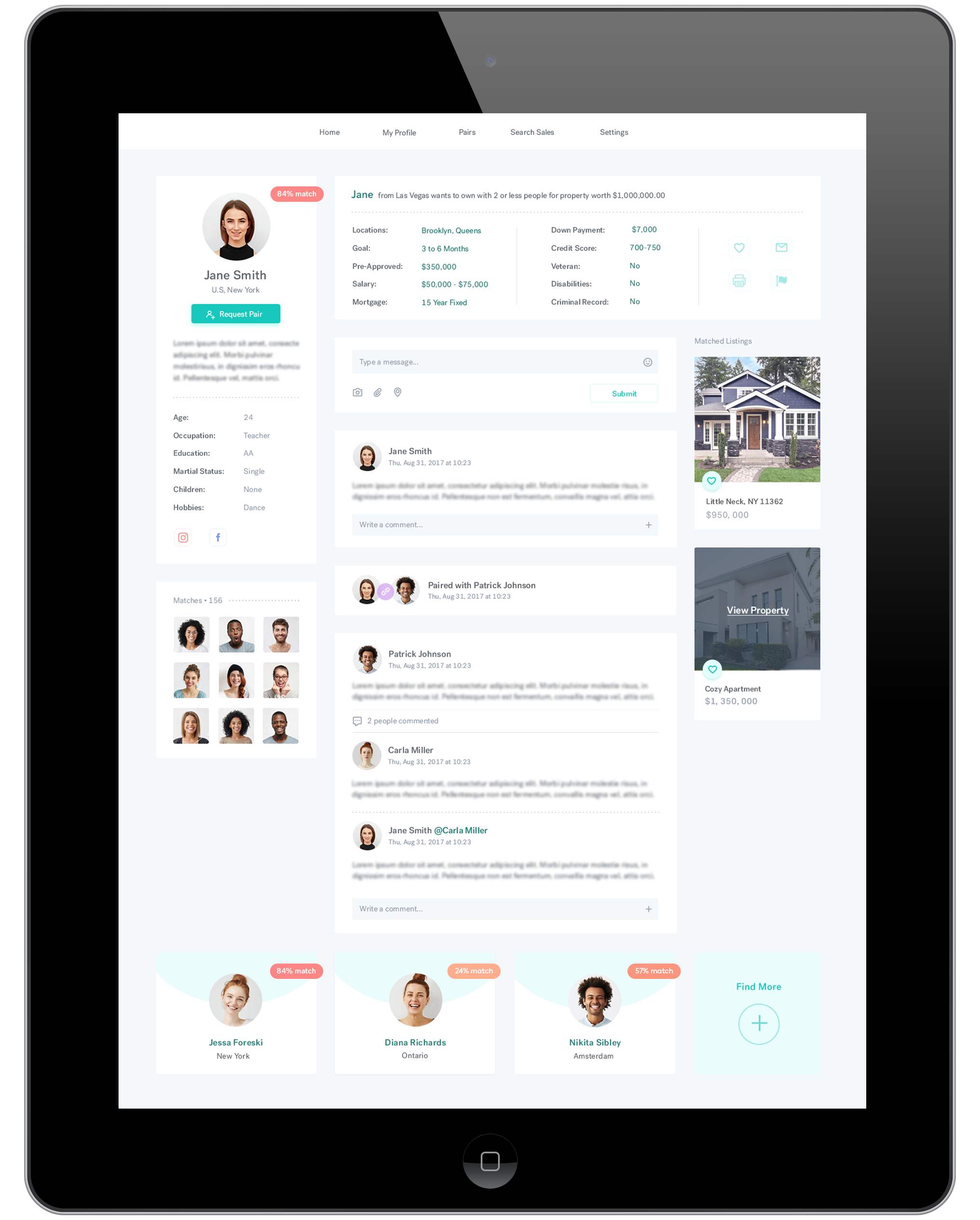

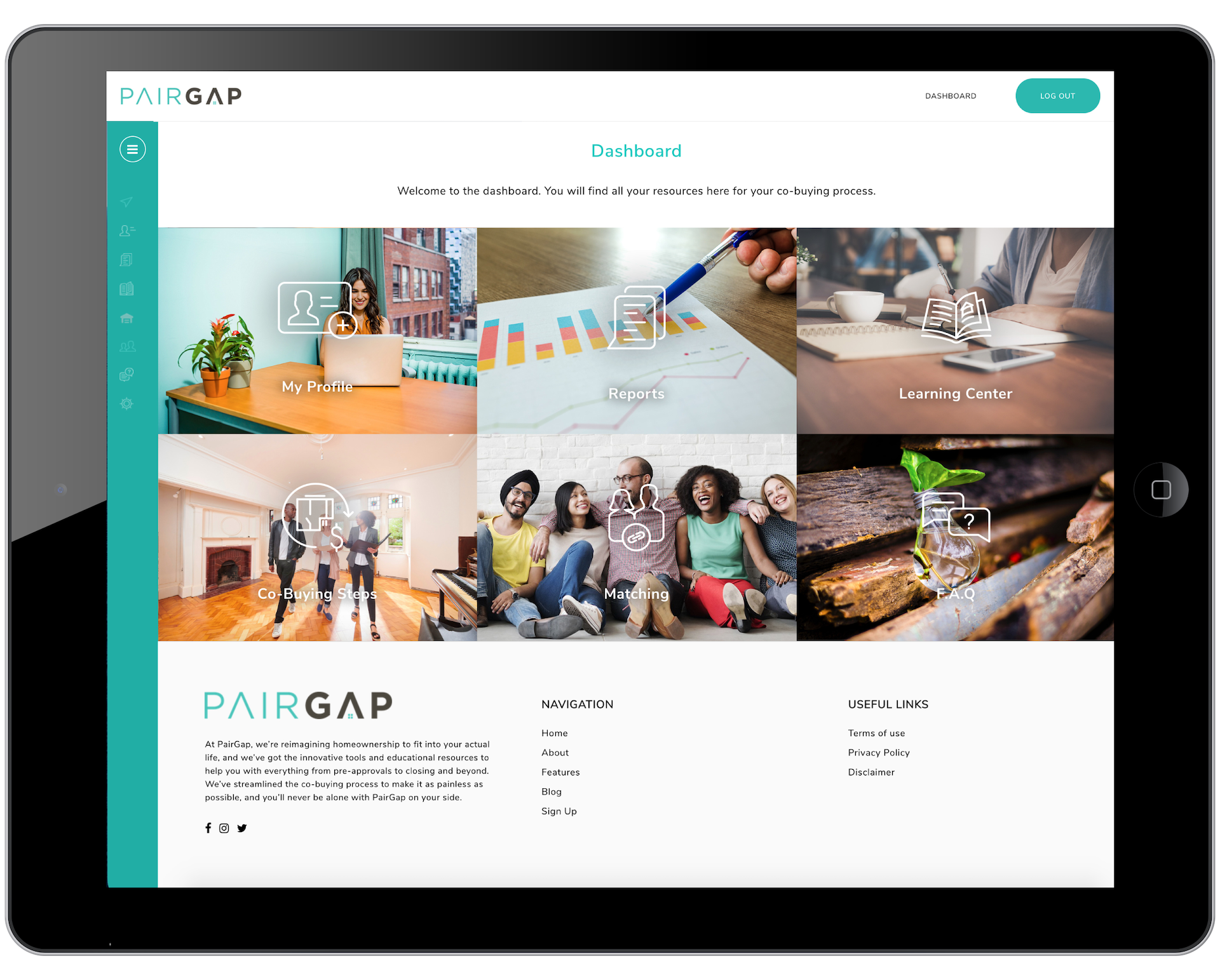

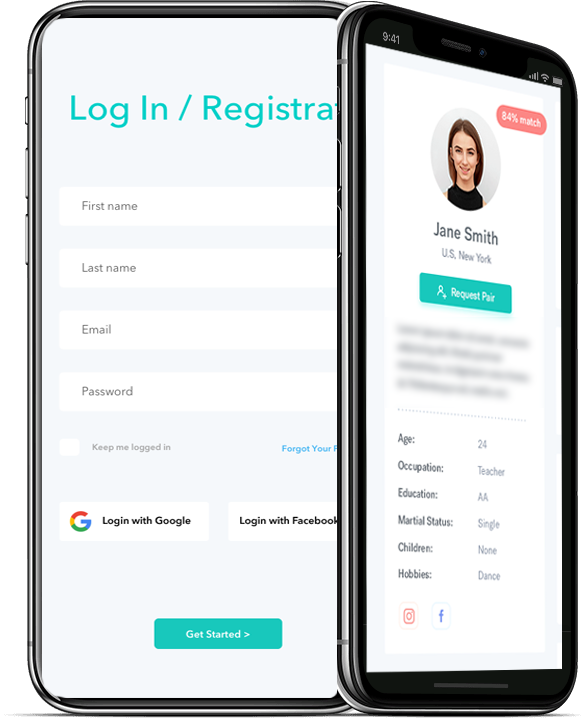

Co-ownership helps mitigate the hurdles of homeownership and Increases your chances of loan approval. At PairGap, we’re reimagining homeownership to fit into your actual life and we’ve streamlined the co-buying process to make it as painless as possible.

And this doesn’t only mean finding the perfect home. It’s about finding the right loan, payment plan, location, and everything in between. We’re revolutionizing homebuying, guiding you every step of the way.

We’re breaking down industry walls and putting the power of homeownership in YOUR hands.